Allocation Approach PAA is designed to simplify the accounting process for certain types of contract. What is the premium allocation approach.

Ifrs 17 9 Series Asset Allocation Considerations Insurance Asset Risk

It is conceptually similar to current practice and generally provides a workable solution for PC insurers.

Allocation of paa plus. The PRU link assurance account plus PAA Plus is a regular-pay payable up to age 100 unit-linked life insurance product. Plus any additional onerous contract liability Directly attributable acquisition costs Liability for remaining coverage Like Unearned Premium Reserve but net of DAC and premium receivables Like best estimate claim reserves but expected value. Instead FASB require the PAA to be used where the eligibility criteria are met.

The following is a table summarizing the projected insurance charges based on male and non-smoker. It provides living disability and death benefits. Total number of units and their equivalent money value are known.

For policies with an annual premium less than 2400. Since PAA has a mininum deposit of 100 a month or 1200 a year we can deduce the mode of deposit is on monthly basis. High insurance charges of the PRUlink protection plus account.

200 TRUE OR FALSE The loyalty bonus in Paa plus gives 15 of the regular premium in Philippine Peso starting on the eleven 11 through year twenty 20 if regular premiums are paid for the first ten 10 years and are continuously paid thereafter as they. IFRS 17 assessment GIs took the view that they would follow PAA the Premium Allocation Approach which has been designed for shorter duration insurance contracts and which would be simpler than the GMM approach General Measurement Method in two key ways. This information gives a basis for users of financial statements to assess the effect that.

0 on the first year. The opening liability plus Premiums received during the period less Insurance acquisition cash flows if applicable plus. The PRULink Assurance Account Plus PAA Plus is a regular-pay payable up to age 100 unit-linked life insurance product.

It provides living disability and death benefits. 125 of all top-ups less 125 of all withdrawals on the top-up units. How much is the fund allocation for PAA plus on the first year.

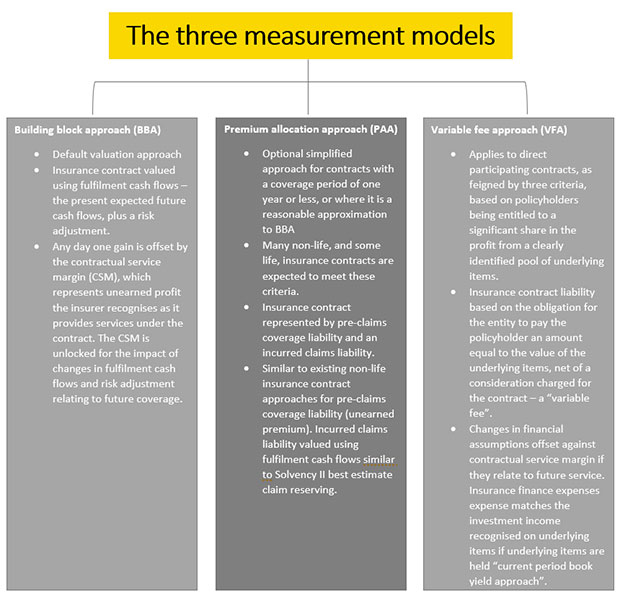

Total charges deducted from the account amount to 6057. Contract Boundary Under PAA what facts and circumstances would indicate a set of contract is onerous. The PAA approach Premium Allocation Approach PAA is a simplified approach allowed for the measurement of the insurance contracts for the remaining coverage period pre-claims.

Accelerated Total and Permanent Disability - a cash benefit deducted from the base plan and paid in advance in case of sickness or injury. Plus an explicit risk adjustment for non- financial risk ie. Optional use of premium allocation approach PAA if eligible.

A percentage of your regular premium is used to buy units at the offer price in the PruLink Fund or Funds you have chosen. The objective of IFRS 17 is to ensure that an entity provides relevant information that faithfully represents those contracts. There are 2 additional investment of 50 which enjoy 100 allocation.

IFRS 17 establishes the principles for the recognition measurement presentation and disclosure of insurance contracts within the scope of the standard. Default to building blockvariable fee approach BBAVFA otherwise. Life Care Plus a cash benefit paid to the insured who has been diagnosed with or has undergone surgery due to any of the 36 critical illnesses covered.

Plains All American Pipeline PAA -357. Asset Premium - 10000. Accidental Death and Disablement - an additional cash benefit in case the.

An entity may apply a simplified measurement approach the Premium Allocation Approach or PAA to the liability for remaining coverage of some insurance contracts meeting specific criteria. Allocation approach PAA. The PRUlink assurance account plus PAA Plus is your insurance plus investment plan.

This can be availed up to four times if its for. Life Care Advance Plus a cash benefit of 25 of the rider benefit amount paid in advance if the insured is diagnosed with any of the 10 identified early stage critical illnesses. Because they want an account plus any sum assured of reviews on this sentence and review and vlpi be sure to insure it also fast and.

It is only available in peso denominations. 55000 plus cash value of units Crisis Cover Provider III. Premium allocation approach mechanics time value of money and remaining coverage Papers 3E and 3G.

PAA is a simplified model General Measurement Model GMM Discounting Risk adjustment Expected value of future cash flows Contractual service margin Current UPR less DACIFRSGAAP Premium Allocation Approach PAA Premium Less acquisition costs2 Liability for remaining coverage unexpired risk PAA and undiscounted1 incurred claims Premium. The entity opted to accrete interest on the PAA liability The entity opted to recognise acquisition costs over the coverage period Credit liabilities and incomes shown with minus Debits assets and expenses shown with plus Premium Allocation Approach General Model Initial measurement FCF CSM Bank Ins. The eligibility criteria for PAA.

At their January 2012 educational meetings the Boards discussed matters related to mechanics of applying the PAA. But what complexities must you consider when adopting the PAA. Dalbars Prudent Asset Allocation PAA strategy separates an investors assets into two different categories.

Rebalancing is task with maintaining your allocation of investments among market segments although bloom is accomplished by reducing your trip Value allocated to weave better performing Investment Divisions. Maturity benefit - sum assured plus the fund value. With regard to the high charges this is true especially when you are old.

200 TRUE OR FALSE The loyalty bonus in Paa plus gives 15 of the regular premium in Philippine Peso starting on the eleven 11 through year twenty 20 if regular premiums are paid for the first ten 10 years and are continuously paid thereafter as they. Death benefit - sum assured plus the fund value. Year Annual mode Other modes.

Using fulfilment cash flows plus risk adjustment. So subject to proof of eligibility you could also apply the PAA to single premium contracts that last longer than a year or multi-year regular premium contracts. 0 on the first year.

The Premium Allocation Approach PAA is a simplified approach to measuring the liability for remaining coverage only The key simplification is to exempt the insurer from calculating and explicitly accounting. Preservative assets and growth assets. The premium allocation approach measures the liability for remaining coverage associated with a group of insurance contracts at the end of a reporting period as the sum of.

PAA earnings call for the period ending December 31 2021. In Dalbars estimation the assets most suitable for preservation are Treasury bills 10-year Treasuries as well as guaranteed annuities and FDIC-insured bank deposits. It is available in peso and dollar denominations.

The table below shows the percentage of your regular premiums that is invested in a particular year. How much is the fund allocation for PAA plus on the first year.

Edgar Filing Documents For 0001193125 21 304186